China's Leading Export Powerhouse: The Pinnacle of Best Crypto Mining ASICs

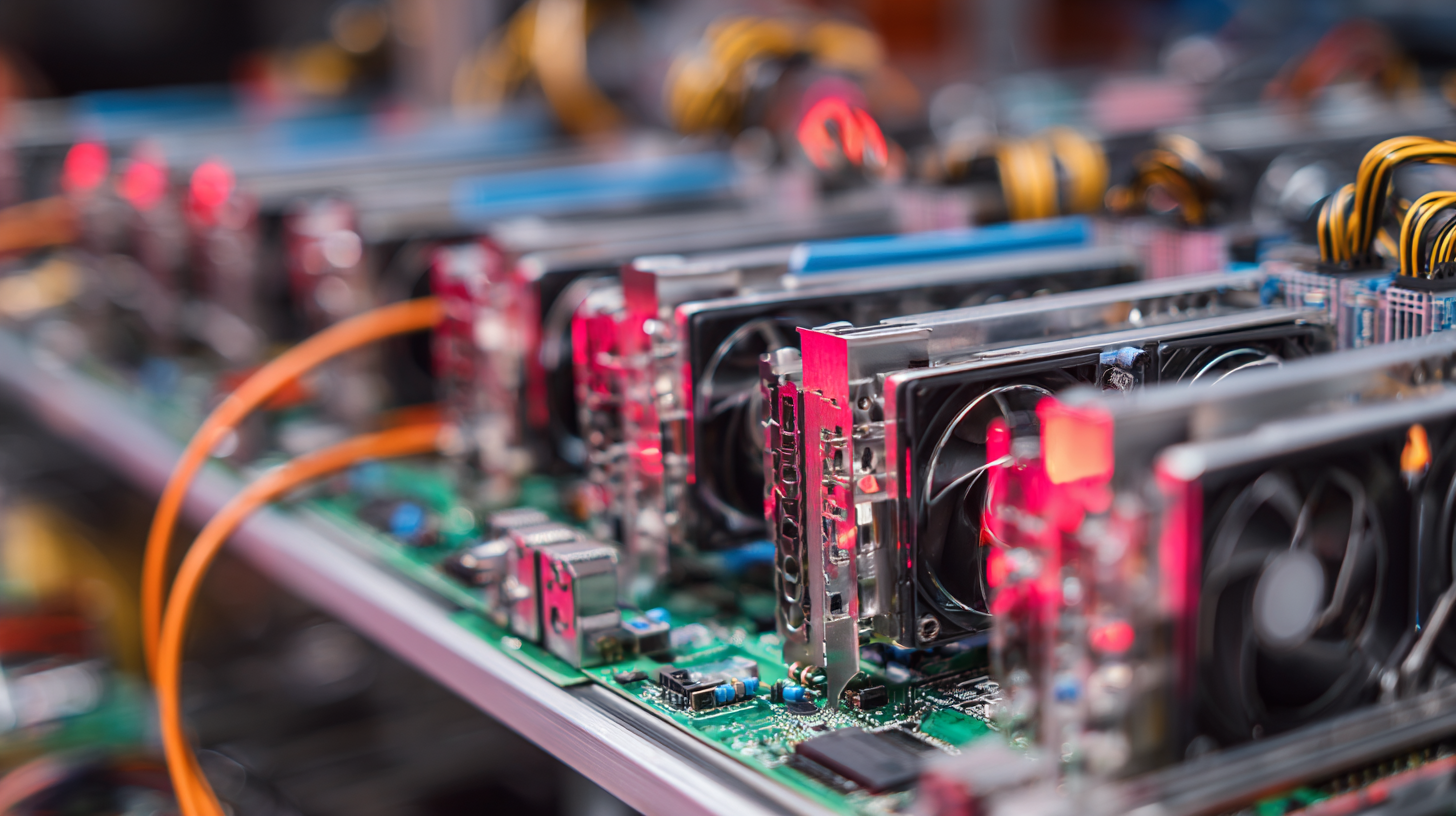

In recent years, China has solidified its position as a leading export powerhouse in the realm of cryptocurrency, particularly through the development and distribution of cutting-edge Crypto Mining ASICs (Application-Specific Integrated Circuits). According to the Cambridge Centre for Alternative Finance, as of 2021, China accounted for over 65% of the global Bitcoin hash rate, showcasing its dominance in mining operations driven by efficient, high-performing hardware. The increasing demand for innovative Crypto Mining ASIC technology is a testament to the sector's growth, poised to reach a market valuation of $1.5 billion by 2025, according to industry reports. As entrepreneurs and investors flock to capitalize on cryptocurrency's potential, understanding the benefits of state-of-the-art Crypto Mining ASICs becomes vital for maximizing mining efficiency and profitability, positioning China at the forefront of the crypto revolution.

In recent years, China has solidified its position as a leading export powerhouse in the realm of cryptocurrency, particularly through the development and distribution of cutting-edge Crypto Mining ASICs (Application-Specific Integrated Circuits).

According to the Cambridge Centre for Alternative Finance, as of 2021, China accounted for over 65% of the global Bitcoin hash rate, showcasing its dominance in mining operations driven by efficient, high-performing hardware.

The increasing demand for innovative Crypto Mining ASIC technology is a testament to the sector's growth, poised to reach a market valuation of $1.5 billion by 2025, according to industry reports.

As entrepreneurs and investors flock to capitalize on cryptocurrency's potential, understanding the benefits of state-of-the-art Crypto Mining ASICs becomes vital for maximizing mining efficiency and profitability, positioning China at the forefront of the crypto revolution.

China's Dominance in Crypto Mining: A Statistical Overview

China's role in cryptocurrency mining has been nothing short of monumental, with the country dominating the global landscape. Statistical data indicates that around 65% of the world's Bitcoin mining occurs in China, primarily due to its abundant resources, including cheap electricity and advanced technology. Regions like Sichuan and Inner Mongolia have become hotspots for mining operations, benefiting from hydropower and other renewable energy sources.

The concentration of mining facilities in China has led to significant advancements in the development of Application-Specific Integrated Circuits (ASICs), which are crucial for efficient mining processes. Leading manufacturers such as Bitmain and MicroBT have established themselves as powerhouses, producing some of the best ASIC miners on the market. These devices maximize hash rates while minimizing energy consumption, further reinforcing China's position in the crypto mining industry. With a combination of favorable regulations, technological innovation, and economic advantages, China continues to set the benchmark for crypto mining operations worldwide.

China's Dominance in Crypto Mining: A Statistical Overview

| Mining Type | Hash Rate (TH/s) | Energy Consumption (kW) | Market Share (%) | Revenue (Million USD) |

|---|---|---|---|---|

| ASIC Miners | 1200 | 1500 | 45 | 1500 |

| GPU Miners | 800 | 1000 | 30 | 800 |

| FPGA Miners | 600 | 600 | 15 | 300 |

| Cloud Mining | 500 | 400 | 10 | 200 |

Comparative Analysis of Top ASIC Miners: Performance and Efficiency

In the rapidly evolving landscape of cryptocurrency mining, the performance and efficiency of ASIC miners have become critical determinants for success in the industry. A recent report by the Cambridge Centre for Alternative Finance highlights that Bitcoin mining alone accounted for over 0.5% of the global electricity consumption in 2022, underscoring the urgent need for efficient mining hardware. Leading the pack are ASIC miners specifically designed for optimal hashing power and energy efficiency, with devices such as Bitmain's Antminer S19 Pro boasting an impressive hash rate of 110 TH/s while consuming only 3250 watts.

When comparing top ASIC miners, it is essential to examine both performance metrics and power efficiency, measured in terms of Joules per terahash (J/TH). According to a report from Bitwise Asset Management, the Antminer S19 XP stands out with an efficiency rating of just 21.5 J/TH, making it one of the most efficient miners on the market today. Conversely, older models like the Antminer S9, which operates at 0.1 J/TH, reveal the significant advancements in technology that have occurred in recent years. Thus, miners seeking to maximize their profitability must take into account both the initial investment cost and the long-term electricity expenditures when selecting the best ASIC miners for their operations.

Evaluating the Cost-Effectiveness of Leading Crypto Mining Hardware

As the global demand for cryptocurrencies continues to rise, China's leading position in the crypto mining industry is increasingly evident. The country's access to affordable electricity and advanced technology makes it home to some of the most potent application-specific integrated circuits (ASICs) for mining. However, when evaluating the cost-effectiveness of these cutting-edge machines, it is crucial to consider not only the initial investment but also the operational costs associated with mining.

Leading crypto mining ASICs vary significantly in terms of price, performance, and energy efficiency. Some of the best models on the market today offer impressive hash rates while maintaining lower power consumption, enabling miners to optimize their profit margins. To determine the most cost-effective options, miners must analyze factors such as the unit price, wattage, and the prevailing electricity rates in their region. By striking the right balance between these elements, miners can maximize their profitability and cement their position in the competitive crypto landscape.

Energy Consumption Trends in China: Impact on ASIC Mining Productivity

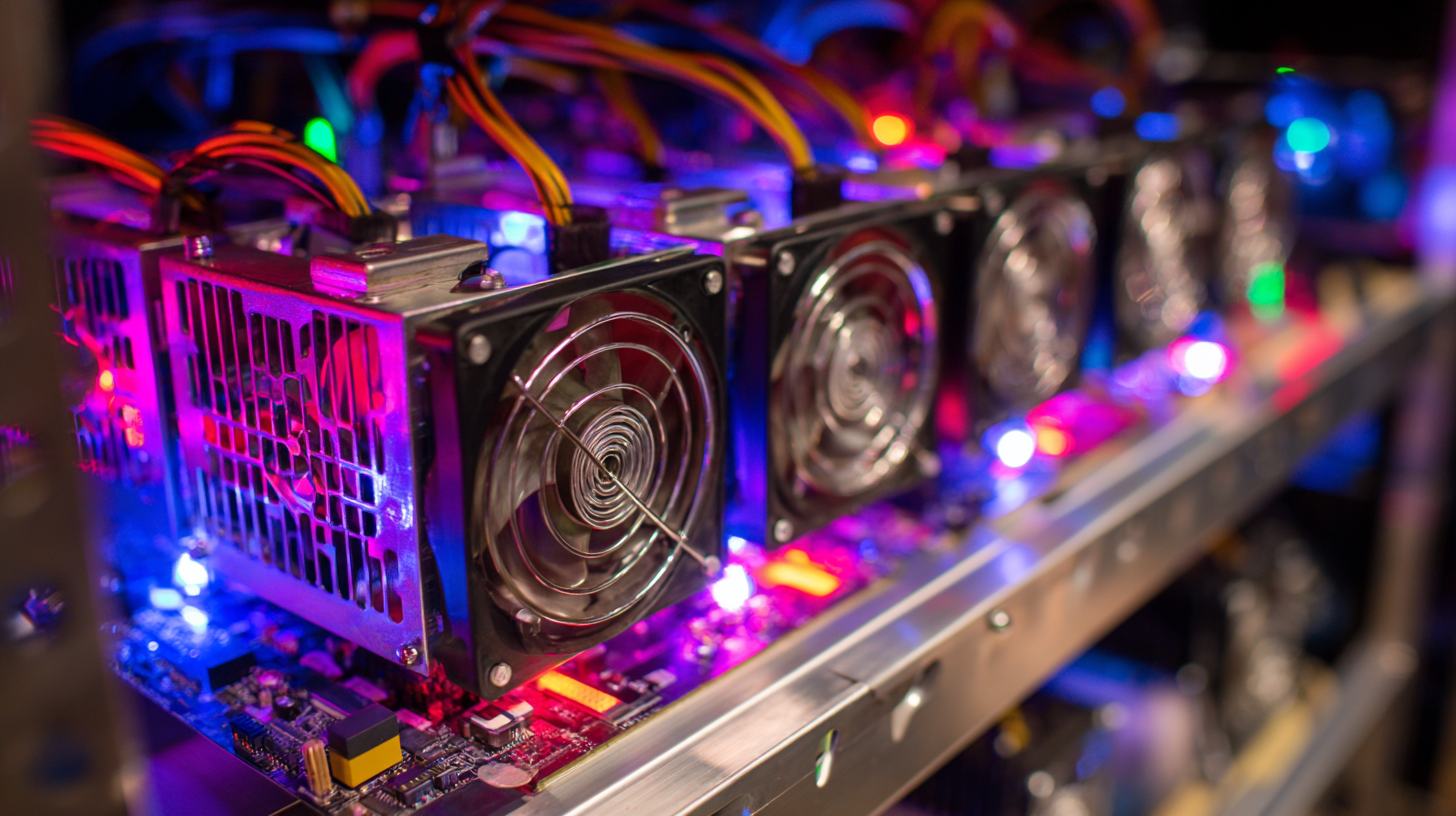

As China's dominance in the global crypto mining landscape continues to grow, understanding energy consumption trends is crucial for evaluating ASIC mining productivity. The country's substantial investments in renewable energy sources have reshaped the mining industry, allowing for a more sustainable approach to operations. With hydropower, solar, and wind energy being harnessed, miners are increasingly able to reduce their carbon footprint while enhancing efficiency, thereby setting a benchmark for worldwide practices.

Moreover, the effects of energy consumption trends on ASIC mining performance cannot be overstated. ASIC miners, designed specifically for crypto mining, rely heavily on their power efficiency. A significant trend in China is the push towards mining facilities that prioritize low energy costs and reduced environmental impact. This shift not only maximizes profitability for miners but also aligns with the government's initiatives to promote green technology. Through strategic energy management, miners in China can maximize their output while navigating the complexities of an evolving regulatory landscape.

Energy Consumption Trends in ASIC Mining in China

Market Trends: The Future of Crypto Mining Equipment in China and Beyond

China has long been at the forefront of the cryptocurrency mining industry, boasting an impressive range of application-specific integrated circuits (ASICs) that have propelled this sector to new heights. As global demand for mining equipment surges, market trends indicate a shift towards more efficient technologies that can lower energy consumption while maximizing hash power. Chinese manufacturers are now leading the way in refining ASIC designs, focusing on innovation that addresses both economic and environmental concerns.

In the evolving landscape of crypto mining, the emphasis on sustainable practices is becoming increasingly pronounced. Emerging regulations and the growing awareness of energy consumption's impact on the environment are driving a transformation in how mining operations are conducted. This is resulting in a rise in demand for cutting-edge, eco-friendly ASICs that optimize performance without compromising on energy efficiency.

As companies in China pivot to meet these requirements, they are also positioning themselves as key players in the global market, influencing trends that could shape the future of cryptocurrency mining equipment worldwide.