How to Choose the Best Crypto Miner For Sale in 2026?

In 2026, choosing the right Crypto Miner For Sale is crucial. The cryptocurrency landscape continues to evolve rapidly. According to recent reports, Bitcoin mining alone consumes over 100 terawatt-hours annually. This figure underscores the significance of efficient mining hardware.

With varying energy costs and mining difficulty levels, selecting a miner can be daunting. Powerful models may promise higher returns, yet they also come with higher power consumption. Buyers must assess not just the initial cost but also the long-term operational expenses.

The need for sustainability is more pressing now. Miners that prioritize energy efficiency can significantly reduce environmental impact. As the market matures, informed decisions can make a difference. It’s not just about profit; it’s about supporting responsible mining practices that benefit everyone.

Identifying Your Mining Goals and Budget for 2026

When considering crypto mining in 2026, identifying your goals is crucial. Are you aiming for profit, or do you want to support blockchain technology? Understanding the purpose behind your mining efforts can shape your entire approach. Many miners enter the market with high expectations but leave disappointed. Setting realistic goals is essential.

Budget plays a significant role as well. Determine how much you're willing to invest upfront. Costs can vary widely—hardware, electricity, cooling systems, and other expenses add up quickly. A common mistake is underestimating ongoing costs. Have a clear understanding of your financial limits. This will help in selecting the right equipment.

It's also important to reassess your strategy regularly. The crypto market is volatile, and what works now may not work later. Are you ready to pivot if things do not go as planned? Reflecting on your strategy keeps you agile. Many miners experience regret due to a lack of adaptability. Always be open to learning and adjusting your goals.

Cryptocurrency Mining Costs and Returns in 2026

Evaluating Hardware Specifications for Optimal Mining Performance

When selecting a crypto miner for optimal performance in 2026, hardware specifications are crucial. ASIC miners lead the pack due to their efficiency. According to the Blockchain Research Institute, miners with a hash rate above 100 TH/s yield higher returns, particularly for Bitcoin. Remember, not every high hash rate miner is the best choice. Energy consumption must be considered. Miners operating at 30 J/TH or less are generally more cost-effective.

Cooling systems matter too. Miners generate heat, necessitating effective cooling solutions. Inadequate cooling can lead to hardware failure. A 2022 industry survey indicated that overheating accounts for 25% of miner failures. Investors should evaluate cooling technologies alongside processing capabilities. Additionally, consider the miner’s longevity. Some devices may only support a couple of years of software updates, which can hamper performance in evolving networks.

Lastly, pay attention to the price-to-performance ratio. A cheap miner with high energy costs may not yield profits. The market may offer devices with appealing initial prices but hidden expenses may reduce returns. Balancing these metrics is essential for sustainable mining operations.

Understanding Energy Efficiency and Operational Costs

When choosing a crypto miner, energy efficiency is a key factor. A report by the Cambridge Centre for Alternative Finance suggests that energy consumption in mining can be staggering, with estimates reaching up to 120 terawatt-hours annually. This high energy demand directly impacts operational costs. Miners need to balance performance with energy usage.

Operational costs extend beyond just electricity. Cooling systems are critical for miners. An inefficient system can increase costs significantly. A study revealed that cooling could account for 20% of total mining expenses. Proper ventilation and temperature control are essential. This serves as a reminder that an efficient setup isn't merely about the hardware.

Investing in tools that enhance energy efficiency can be wise. Smart miners might offer better power management. However, the initial cost for these may be higher. The choice often leads to juggling between upfront costs and long-term savings. Decisions can be tough, as the landscape continuously shifts. Keeping informed about the latest data is crucial for anyone serious about mining.

How to Choose the Best Crypto Miner For Sale in 2026? - Understanding Energy Efficiency and Operational Costs

| Miner Model | Hash Rate (TH/s) | Power Consumption (W) | Energy Efficiency (J/TH) | Operational Cost ($/day) | Estimated ROI (Months) |

|---|---|---|---|---|---|

| Model A | 100 | 3200 | 32 | $7.68 | 10 |

| Model B | 110 | 3400 | 30.91 | $8.16 | 9 |

| Model C | 90 | 3000 | 33.33 | $7.20 | 11 |

| Model D | 95 | 3100 | 32.63 | $7.44 | 10.5 |

| Model E | 105 | 3300 | 31.43 | $8.00 | 9.5 |

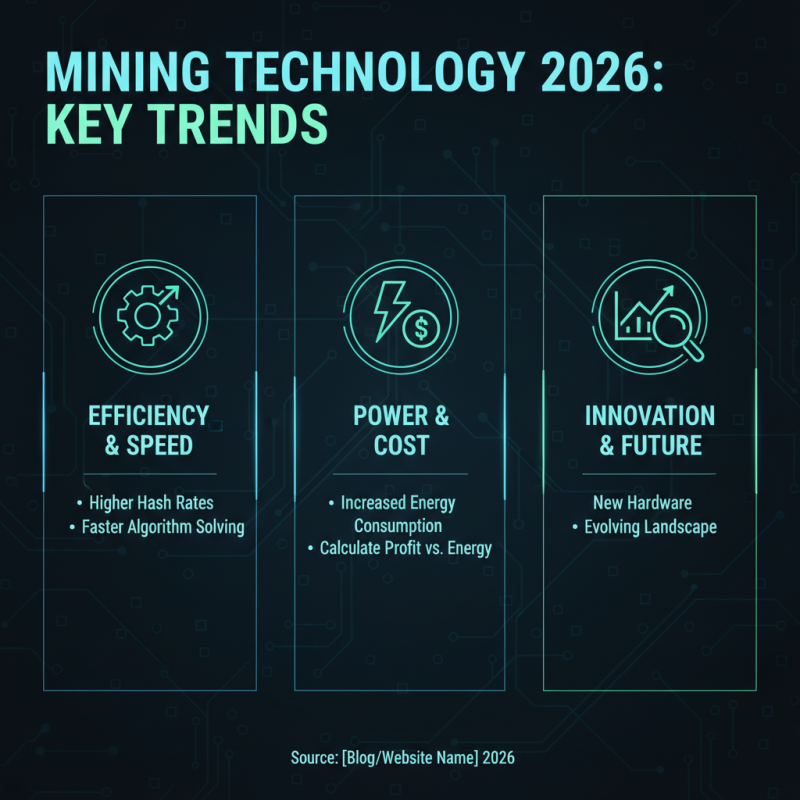

Researching the Latest Mining Technologies and Innovations

When exploring the latest mining technologies, one must consider various innovations shaping the landscape in 2026. Efficiency is key. New mining hardware often boasts higher hash rates. This means miners can solve complex algorithms faster. However, with increased power comes higher energy consumption. It’s vital to calculate potential profitability against energy costs.

Cooling systems also warrant attention. As miners work harder, overheating becomes a severe issue. Emerging cooling solutions use innovative methods. These can significantly increase hardware longevity. Yet, the initial investment in advanced cooling equipment may seem daunting.

Software advancements are equally important. Top-tier software can optimize mining operations. Simple interfaces make management easier. But, not all software fits every miner's needs. Regular updates and community support play critical roles in a software's effectiveness. Users must stay informed and adapt to changes. Exploring these aspects requires time and research, leading to both opportunities and uncertainties in buyer decisions.

Comparing Reputable Sellers and Market Trends for Crypto Miners

When buying a crypto miner in 2026, it’s essential to compare reputable sellers. Check online reviews and community feedback. Look for sellers with a strong track record. If a seller has negative reviews, note it. Trust in the seller can make a significant difference in your purchase experience.

Market trends also play a crucial role in your choice. Prices can fluctuate based on demand and technology advancements. Pay attention to new releases and innovations. Some miners offer better energy efficiency or higher hash rates. However, these features may not be essential for everyone.

Consider the long-term profitability of your investment. Sometimes, cheaper options can perform just as well over time. Reflect on what suits your needs. Analyzing both sellers and market trends will help you make an informed decision. Don’t rush; take the time to weigh your options thoughtfully.

Related Posts

-

Exploring Alternative Crypto Miners for Sale: Comparing Efficiency and Cost-Effectiveness in 2023

-

Top 10 Crypto Miners to Buy for Maximum Profit in 2023

-

The Ultimate Guide to Sourcing the Best Miner Power Suppliers for Your Business

-

2025 Bitcoin Mining Container Market Insights and Essential Strategies for Success

-

Ultimate Guide to Selecting the Best Crypto Mining Asic Hardware for Maximum Profitability

-

Top 5 Asic Crypto Miner Choices for 2023 with Highest Hash Rates and Best ROI