Top 10 Btc Asic Miner Models to Boost Your Cryptocurrency Mining Strategy

In the rapidly evolving landscape of cryptocurrency mining, the importance of selecting the right hardware cannot be overstated. Among the various options available, the BTC ASIC miner models stand out for their efficiency and effectiveness in processing Bitcoin transactions. As miners aim to enhance their profitability, understanding the capabilities and features of different ASIC miners becomes crucial. This guide will explore the top 10 BTC ASIC miner models that can elevate your cryptocurrency mining strategy and optimize your operations.

These specialized devices are designed for a single purpose: mining Bitcoin. By harnessing advanced technology and superior hashing power, BTC ASIC miners outperform traditional mining hardware and provide significant advantages in energy consumption and processing speed. In this overview, we will delve into the characteristics that set these models apart and how they contribute to a more robust and profitable mining environment, allowing enthusiasts and serious miners alike to make informed decisions in a competitive market. Discover how the right BTC ASIC miner can drive your success in the world of cryptocurrency mining.

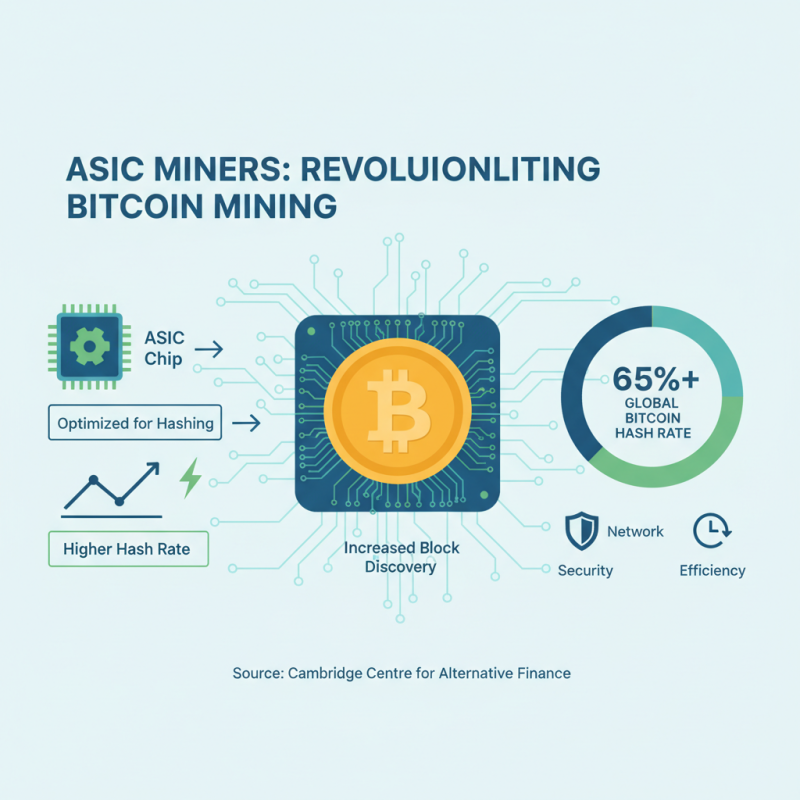

Understanding ASIC Miners and Their Role in Cryptocurrency Mining

ASIC (Application-Specific Integrated Circuit) miners have revolutionized the landscape of cryptocurrency mining, particularly for Bitcoin. Unlike general-purpose hardware, ASIC miners are specifically designed to perform calculations required for mining efficiently. Their optimized architecture allows them to deliver a higher hash rate, which directly translates to increased chances of successfully mining new blocks. According to a report by the Cambridge Centre for Alternative Finance, over 65% of the global Bitcoin hash rate is dominated by ASIC miners, highlighting their critical role in maintaining the network's security and efficiency.

The efficiency of ASIC miners is measured in joules per terahash (J/TH), which indicates how much energy is consumed to generate one terahash of mining output. Recent advancements in ASIC technology have led to models achieving energy efficiencies as low as 30 J/TH, significantly reducing operational costs for miners. In a competitive market where electricity prices can dramatically impact profitability, miners equipped with the latest ASIC technology can achieve higher returns on investment. Data from the Bitcoin Mining Council suggests that, as of 2023, the global Bitcoin mining industry is striving towards more sustainable energy sources, with over 50% of miners utilizing renewable energy, thereby making ASIC miners not only efficient but also environmentally friendly in the long run.

Key Features to Consider When Choosing a Bitcoin ASIC Miner

When selecting a Bitcoin ASIC miner, there are several key features that should be considered to optimize your cryptocurrency mining strategy. First and foremost, hash rate is crucial. The hash rate determines how quickly your miner can solve complex cryptographic problems, ultimately influencing your mining success and profitability. Higher hash rates generally lead to more rewards, so it's essential to choose a model that can offer competitive performance.

Another important factor to consider is energy efficiency. As mining operations can consume a substantial amount of power, choosing an ASIC miner with a high efficiency rating (measured in joules per terahash) can significantly reduce operational costs. This is especially important given the fluctuating energy prices in different regions. Finally, consider the miner's cooling capabilities. Efficient cooling solutions can help maintain optimal performance and extend the lifespan of your equipment, ensuring that your investment lasts through varying market conditions.

Top 10 BTC ASIC Miner Models: Performance and Efficiency Overview

When assessing the effectiveness of cryptocurrency mining operations, particularly with BTC ASIC miners, performance and efficiency stand out as critical metrics. Recent industry reports highlight that the average hash rate of leading ASIC miners has significantly increased, achieving levels exceeding 100 TH/s. This advancement not only boosts mining capacity but also enhances the likelihood of successfully adding blocks to the blockchain. For miners, this means increased potential profit margins in an ever-competitive market.

Energy consumption is another vital aspect of evaluating ASIC miner models. Current studies indicate that the best-performing miners achieve energy efficiencies around 25 J/TH or lower, setting a crucial benchmark for profitability. As electricity costs continue to rise in many regions, selecting miners with higher energy efficiencies can significantly impact overall profitability. Additionally, insights from online mining calculators suggest that the profitability per unit of electricity consumed varies widely, meaning miners must do their due diligence to ensure they are investing in models that offer both high performance and low operational costs.

As the market evolves, focusing on these characteristics will be essential for both new and seasoned miners aiming to optimize their cryptocurrency mining strategy.

Comparing Cost and ROI of Leading Bitcoin ASIC Miners

When considering a Bitcoin mining strategy, it's essential to evaluate the cost and return on investment (ROI) of various ASIC miners available in the market. The initial investment in hardware can be substantial, so understanding the financial implications is crucial. Factors like power consumption, hash rate efficiency, and the current market price of Bitcoin play a significant role in determining profitability. Miners must analyze their electricity costs alongside the miner's performance, as these can dramatically affect overall earnings.

In addition to initial costs, potential miners should factor in the longevity and durability of the equipment they choose. Some models may have a lower upfront cost but could incur higher maintenance and operational expenses over time. It’s also advisable to keep an eye on technological advancements, as the ASIC mining landscape evolves rapidly. Comparing different models based on their hash rates, energy efficiencies, and ROI timelines allows for informed decision-making. By strategically selecting the right ASIC miner, individuals can maximize their investment and enhance their cryptocurrency mining profitability.

Top 10 BTC ASIC Miner Models to Boost Your Cryptocurrency Mining Strategy

| Model | Hash Rate (TH/s) | Power Consumption (W) | Cost ($) | ROI (Months) |

|---|---|---|---|---|

| Model A | 110 | 3250 | 4000 | 6 |

| Model B | 90 | 3500 | 3500 | 8 |

| Model C | 85 | 3250 | 3300 | 9 |

| Model D | 100 | 4000 | 4200 | 7 |

| Model E | 95 | 3600 | 3700 | 8.5 |

| Model F | 120 | 2800 | 4800 | 5 |

| Model G | 75 | 2000 | 2500 | 10 |

| Model H | 130 | 3200 | 5000 | 5.5 |

| Model I | 115 | 3100 | 4600 | 6.5 |

| Model J | 80 | 2400 | 3000 | 9.5 |

Future Trends in BTC ASIC Mining Technology and Equipment

The landscape of BTC ASIC mining technology is rapidly evolving, driven by advancements that enhance efficiency and profitability. A significant trend in this sector is the ongoing development of more powerful and energy-efficient mining chips. These innovations not only increase hash rates, allowing miners to solve complex problems faster, but also drastically reduce power consumption. As energy costs continue to rise, the focus on energy efficiency will be paramount, encouraging miners to upgrade to the latest technologies that promise better returns on investment.

Moreover, the integration of artificial intelligence and machine learning into mining operations is becoming increasingly prevalent. These technologies facilitate smarter decision-making regarding when to mine, how to optimize operations, and even where to locate mining facilities for maximum efficiency. As miners look to refine their strategies in an ever-competitive market, leveraging data analytics will play a crucial role in identifying trends and improving overall performance. As these technologies shape the future of BTC ASIC mining, they offer a glimpse of how a blend of cutting-edge innovation and strategic planning can redefine the cryptocurrency mining landscape.

Related Posts

-

2025 Mining Revolution Unveiling the Best Btc Asic Miner With 6000 GHs Performance

-

Unveiling the Technical Specifications of Top Notch Asic Mining Equipment at the Best Asic Mining Shop

-

Top 5 Best ASIC Crypto Miners Compared: Which One Reigns Supreme?

-

Ultimate Guide to Selecting the Best Btc Asic Miner for Your Cryptocurrency Needs

-

Exploring Asic Mining Innovations at the 138th China Import and Export Fair 2025

-

2025 Top Crypto Mining Containers for Maximum Efficiency and Profitability