Top 10 Crypto Miners to Buy for Maximum Profit in 2023

As the cryptocurrency market continues to evolve, the demand for efficient mining operations is at an all-time high. According to a recent report by Alesha Dan, an expert in the "Buy Crypto Miner" industry, "Investing in the right mining hardware can lead to significant profits if done wisely." With Bitcoin's price fluctuating around $60,000 and Ethereum solidifying its position as a leading altcoin, miners are looking for the best equipment to capitalize on these trends.

The potential for profit is substantial. In 2022, the crypto mining market was valued at approximately $2 billion, showing a promising upward trajectory. Investors are increasingly interested in the performance and energy efficiency of mining rigs. While it is essential to consider factors like initial costs and projected returns, mining operations require careful planning and strategic decisions.

However, not all mining setups guarantee success. Many miners face challenges like rising energy costs and fluctuating cryptocurrency values. Balancing these risks is crucial. Investing in a quality crypto miner is vital for maximizing profit. But it requires continuous monitoring and adaptation to market changes. Investing in the right equipment today could mean substantial rewards tomorrow, but it’s not without its complexities.

Overview of Cryptocurrency Mining and Its Significance in 2023

Cryptocurrency mining has evolved significantly in 2023. It plays a crucial role in securing networks and validating transactions. Miners utilize powerful hardware to solve complex mathematical problems. This process ensures the integrity of the blockchain. Mining has become more competitive, requiring considerable investment and technical knowledge.

The significance of mining extends beyond profit. It supports decentralization in the cryptocurrency space. Many users benefit from lower transaction fees and faster confirmations. However, the environmental impact of mining is a growing concern. This aspect often overshadows its benefits. Miners face increasing pressure to adopt sustainable practices. Balancing profitability and responsible operations is essential for long-term success.

As the landscape evolves, miners must adapt. Some may struggle to stay profitable amid rising energy costs and competitive pressures. Embracing new technology and strategies is vital. This shifting environment requires diligent reflection and constant learning. Miners must find innovative ways to thrive without compromising ethics. Mining remains a challenging yet rewarding endeavor in the ever-changing world of cryptocurrency.

Criteria for Selecting the Best Crypto Miners for Investment

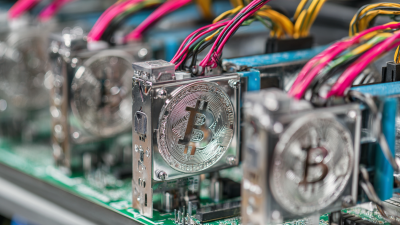

When looking for the best crypto miners to invest in, certain criteria stand out. First, evaluate the technology used in mining. Efficient hardware not only impacts performance but also energy consumption. Choose miners with advanced chips and better hash rates for optimal returns. Additionally, consider the company's track record. A solid history in the crypto space often indicates reliability.

Market conditions play a crucial role as well. Crypto prices can fluctuate dramatically. This unpredictability may affect mining profitability directly. Look for miners that adapt to market changes swiftly. Assessing their business model is another key factor. Transparent pricing and clear operational strategies are essential.

Lastly, community and user feedback can provide insights. Engaging with forums and discussions helps gauge sentiment. However, be cautious of overly positive reviews—some may be misleading. Learning from both successes and failures in other investments can guide your choices. Always remain open to reevaluating your strategies as the market evolves.

Top 10 Crypto Miners to Buy for Maximum Profit in 2023

| Rank | Mining Hardware Type | Hash Rate (TH/s) | Power Consumption (W) | Price ($) | Estimated ROI (%) |

|---|---|---|---|---|---|

| 1 | ASIC Miner | 110 | 3250 | 6000 | 150 |

| 2 | GPU Miner | 45 | 2000 | 2500 | 120 |

| 3 | FPGA Miner | 50 | 1200 | 4000 | 130 |

| 4 | ASIC Miner | 80 | 2500 | 5500 | 110 |

| 5 | GPU Miner | 70 | 2500 | 3000 | 140 |

| 6 | ASIC Miner | 100 | 2800 | 7000 | 160 |

| 7 | GPUs Cluster | 120 | 3000 | 5000 | 175 |

| 8 | ASIC Miner | 95 | 3000 | 6500 | 125 |

| 9 | GPU Miner | 60 | 1800 | 3500 | 115 |

| 10 | FPGA Miner | 40 | 1000 | 2500 | 150 |

Top 10 Crypto Mining Companies with High Profit Potential

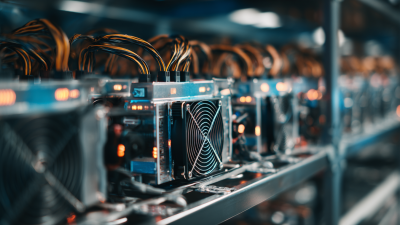

The world of cryptocurrency mining is evolving quickly. Many companies are adapting to changes in technology and market conditions. Investing in these companies can yield high profits, but it’s vital to do thorough research.

Some mining companies focus on renewable energy sources. This choice can reduce costs over time. Others invest heavily in advanced hardware. Faster machines can increase efficiency and output. However, technological advancements often require substantial initial investment. Potential investors should weigh these factors carefully.

The market is unpredictable. While some companies show promise, past performance doesn’t guarantee future success. New regulations or fluctuations in cryptocurrency prices can impact profitability. This is why understanding market dynamics and company practices is crucial for potential investors. Adaptability can be the key to success in this competitive field.

Financial Performance and Market Trends of Leading Crypto Miners

The landscape of cryptocurrency mining is rapidly evolving. Financial performance among top miners can vary widely. Reports indicate that in 2023, profit margins have shifted due to fluctuating energy costs and bitcoin prices. Data shows that energy expenses account for about 30% of operational costs. Miners who effectively manage these expenses tend to thrive.

Market trends indicate a consolidation of operations. Smaller miners are exiting the market, leaving opportunities for larger entities. This shift impacts profitability dynamics. In a recent study, over 60% of miners reported a decrease in their profit margins compared to the previous year. Many are forced to rethink their strategies as market competition intensifies.

Additionally, environmental concerns are becoming significant. Miners face pressure to adopt sustainable practices. Reports suggest that 40% of mining operations now use renewable energy sources. This shift not only helps public perception but can also reduce long-term costs. The path forward is complex. As the industry evolves, miners must adapt to remain viable.

Future Prospects and Risks Associated with Crypto Mining Investments

The crypto mining landscape is evolving rapidly. Investing in this sector promises high returns, yet it comes with significant risks. In 2023, mining profitability is influenced by multiple factors, including energy costs and regulatory scrutiny. Recent reports suggest that over 70% of mining operations face high electricity costs, which can erode profit margins.

Moreover, the shift toward greener energy sources adds complexity. Miners must adapt to sustainable practices or risk losing market position. It's estimated that only 15% of mining operations currently utilize renewable energy. This can be a double-edged sword. While ensuring compliance with regulations is crucial, it may also increase operational costs. Investors should be prepared for fluctuating energy prices and potential regulatory changes.

Security issues are also a concern. Hackers target mining pools and exchanges, leading to potential losses. The recent surge in attacks has raised questions about the safety of investments. Data indicates that security breaches in the crypto sector have risen by 25% in the past year alone. Understanding these risks is vital for anyone looking to invest in crypto mining. Balancing potential rewards with these challenges requires careful consideration.

Top 10 Crypto Miners Performance Analysis in 2023

This chart illustrates the estimated profitability of various cryptocurrency mining operations based on the current market trends and mining efficiencies in 2023. The data reflects the projected profits (in USD) from each miner's mining operation.

Related Posts

-

Exploring Alternative Crypto Miners for Sale: Comparing Efficiency and Cost-Effectiveness in 2023

-

Unleashing Excellence in Global Supply Chains with China's Best Asic Crypto Miner Solutions

-

Top 5 Asic Crypto Miner Choices for 2023 with Highest Hash Rates and Best ROI

-

Understanding the Future of Crypto Asic Miner Technology and Its Impact on Cryptocurrency Mining

-

How to Choose the Best Crypto Mining Containers for Maximum Efficiency

-

Future Technologies Shaping Crypto Mining Container Strategies for 2025